Personal experience. How much is a month of living in California

A similar question, I think, was asked by thousands of people who dream of moving to the golden state. The question is quite reasonable, because you need to understand what kind of salary you should look for and agree with on the offer already received by the employer.

I will try to answer this question using the example of my family. But before you start reading, I would like to advise you not to convert these amounts into rubles, hryvnia, etc. - so as not to experience shock. Still, the level of salaries “here” and “there” is significantly different. In addition, the issue of spending is an individual matter, and some people like to spend on clothes, while others like to spend on travel. This is just the story of one single family.

Let's first get acquainted, to make it clear who earns and spends. My family consists of four people - it's me, my husband and two seven-month-old children. We moved to California from St. Petersburg a year and a half ago. We now live in the small town of Silicon Valley called Foster City, ten minutes by car from San Francisco Airport.

Now only husband works in our family in full time. We rent a one bedroom apartment, we have two cars. On weekdays we eat mostly at home. I have breakfast, lunch and dinner, my husband has only dinner, as he eats breakfast and has lunch at the office, they are fed by the company.

In this blog I will describe our spending in March. It was an ordinary month, and I think that by these figures, in general, it will be clear what is it like. And if you have any questions, I will be happy to answer them in the comments.

- Flat rent

Of course, this is one of the most significant items of expenditure. We pay for the apartment $ 2350 taking into account utility bills (garbage, water and sewage). This amount also includes one parking space in the garage. But electricity and laundry are paid separately (in our apartment there is no washing and drying machines).

- Electricity

We pay for it by meter, and its cost varies from month to month, depending on how often we turn on the heating. On average, this is approximately $30-70 per month. Spring this year in California is cold, and in March we heated actively, and as a result, the bill came in the amount of $69.

By the way, if you are suddenly planning a move to Northern California, be sure to take a scarf, a hat, and even woolen socks with you. I am not kidding! In the autumn-winter-spring period, the heating is on, a cup of hot tea and socks knitted by the caring hands of a grandmother are our everyday life.

- Products

Now we spend on average $700-800 a month on food at home. We are active meat eaters, we love fish and fruit in large quantities. We usually fill the refrigerator once a week, stocking up on fruits and vegetables at Costco (a chain of wholesale stores where everything is sold only in large packages), and everything else at the regular Safeway supermarket. All household chemicals fall into this same expense item, since we usually buy them along with groceries.

- Car expenses

We have two cars in our family, one of which is taken on credit. It costs us $ 362 per month. Both cars have insurance. Relatively speaking, it is a la CASCO + CTP - for one car and CTP - for the second. The cost of both insurance is $ 131 per month. Gasoline in March took $ 125.

- Medical insurance

Insurance is provided against the work of the husband, respectively, the company partially pays, in part we ourselves. The amount automatically deducted from the husband’s salary is $ 280 for basic insurance + $ 40 for dentistry (only for us, it’s not relevant for kids yet, although they already have eight teeth for two. ????

- Child expenses

There are two main items of expenditure - a nanny and baby food. For kids now we are buying a mixture, porridge and various vegetable purees, just in March they began to introduce to children food. So, in March, $ 138 was spent on baby food. Plus $ 40 was spent on diapers. Well, the biggest item of expenditure at the moment is the payment of a nanny, $ 2800 per month.

- Personal care

The category that includes spending on beauty salons and the purchase of all kinds of cosmetics and pharmaceutical products. For example, in March my husband went to get a haircut, paying $66 for the pleasure. Another $46 was spent on my girly needs - hand cream and blush. I always do manicures and pedicures myself, because I don’t like beauty salons, so we successfully save money on these items.

- Shopping

All expenses related to clothing, household goods, books and other things go here. For example, they bought the necessary home for $ 20, plus every little thing in the store Dollar Tree for another $ 8. The remaining $ 53 went to toilet water for her husband. It would be good to add the latter to the category above, but the system in which we conduct the budget decided that this spending place here.

- Gifts

This category includes spending on gifts for each other, as well as for friends and colleagues. Since my husband and I have a common budget, I know that the pan I ordered on March 46 cost me $8. We don’t celebrate March 25th at all and usually don’t give gifts, but this year, for fun, we decided to time the purchase of a new saucepan to coincide with March XNUMXth. Well, so that I also have something to show my girlfriends on Instagram. 🙂 And $XNUMX - my husband chipped in for a colleague’s birthday, which we celebrated at a bowling alley on the ocean shore.

- Entertainment

In March, we spent $ 87 on food outside the house, going to a restaurant three times. In one of them, by the way, a waitress from Japan said that my youngest son looked like a Chinese (I have twins, but not identical in appearance). After this, the child did not smile to outside women for another week. In general, March turned out to be a home month, because it rained almost every weekend, except for two days, when we managed to hold a photo session in honor of half a year of babies and go to Monterey.

- Mobile / Internet

Pay $ 70. The sum consists of $ 40 payment for my mobile (the husband is paid by the company) and $ 30 for paying an interest-free loan for the phone. The Internet bill at 25 Mbps comes in at $ 80.

- Taxes

In March, we filed a tax return, for which we paid $ 25.

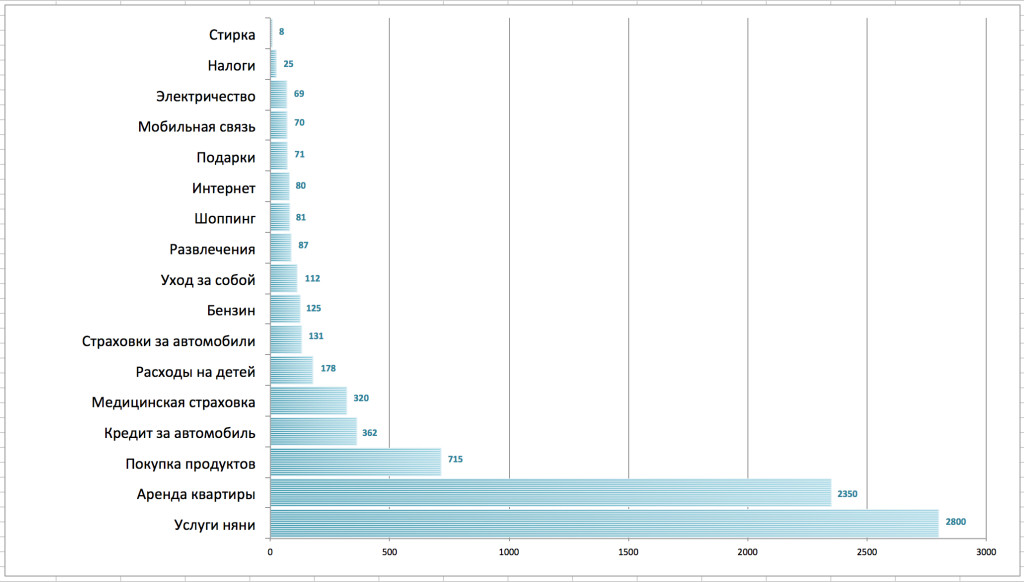

Here's what all our spending looks like in one chart.

Summarizing: in March we spent $ 7584. Of these, life support payments (rental housing, buying groceries, etc.) accounted for $ 4255, plus expenses for children $ 2978. And $ 351 amounted to incidental expenses.

It seems that she has not forgotten anything, she did not miss it, she reported for all the expenses. ???? By the way, there will surely be questions about how we manage the budget and whether we are recording all expenses in a large ledger. Previously, we kept records in the Excel file, where we created our own groupings and the necessary formulas. And now we use the site mint.comwhich automatically reduces all available bank cards to one denominator and spreads spending by category. True, the last thing behind him is to check if this is a crucial moment for you. But more convenient than the system, I have not met.

See also:

Personal experience. How we arrived in the United States on a student visa

From the first person: how Muscovite settles in Los Angeles

Personal experience. How I moved to the US

From the first person. What does the Facebook office look like from the inside?

Go to the page ForumDaily on Facebook to keep abreast of the latest news and comment material.

Subscribe to ForumDaily on Google News