How can you live in the US without credit when you have 13 children

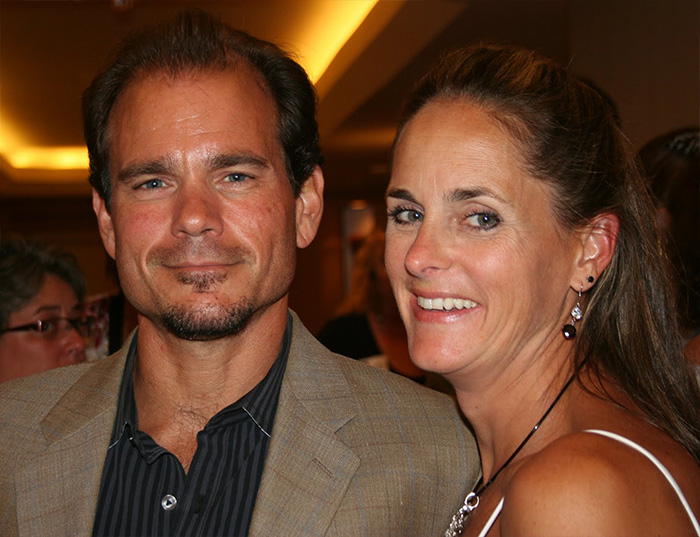

Robert Fetzinger and his wife live in the United States. They raise 13 children. Their washing machine works five times a day. Despite the difficulties, they are happy. Rob describes the family’s budget and tells how they manage on their own, without state support.

Photo madfientist.com

“We’ve been married for 27 years,” says Robert. — I am 51 years old, and my wife is 48 years old. We have 13 children ranging in age from 4 to 26 years old. We gave birth to the first 12 children ourselves, and established guardianship over another one. We started nursing our last child at 12 weeks, we are planning to adopt him soon, but that’s another story...

My wife is from a large family, and she always wanted to have a lot of children. I knew this when I made a marriage proposal. Then he said: "Who else will give you 10 children, a house with a white fence and a dog?" To this she replied: "To kill a dog and make 11 children is a great deal." Do not worry, we did not kill the dog, but we had a lot of rabbits that died a natural death.

My wife and I lead a modest lifestyle. He turned out to be a damn good job. In addition to the mortgage, we never borrowed. We do not have credit cards, car loans or student loans - there is nothing.

And we never had a lot of money. We got married in the 1989 year, and a year later we had our first child. Between 1990 and 2000, we owned a bookstore where we worked together. It was the main source of income, but I worked here and there. During 90, our income did not exceed 36 thousand dollars per year. Then it was not possible to save a lot on pension savings. In the summer of 2000, we closed the bookstore (thanks Amazon and others).

At the insistence of a friend, I decided to take up work in the field of computer software. This work also did not bring a lot of money, but income increased from 40 thousand to 104 thousand dollars a year. My company gives good bonuses in the form of comprehensive insurance (health, teeth and vision), vacations, funded pension and other benefits.

In addition, I receive additional tasks that sometimes increase my income to 110 thousand dollars a year. A good amount, but do not forget about 11 children who live in our house (another child is married, and the second one lives in college).

Starting around 2005, we got enough room for budget maneuvers to save money in retirement accounts. Before they had almost no money.

Our budget

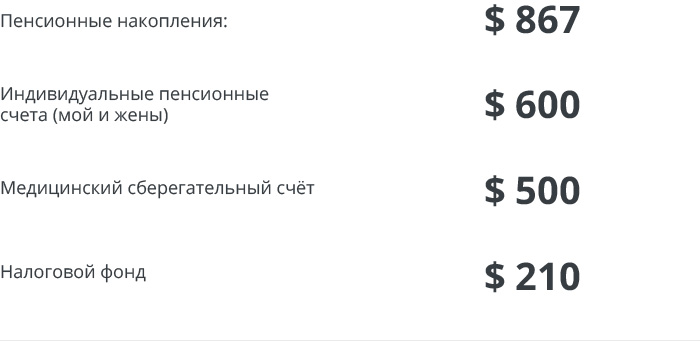

Current financial position:

Pension and medical savings:

Monthly expenses:

Often we can save on savings from 50 to 500 dollars more than I indicated. Thus, our savings rate is approximately 35% of income. Now our total retirement savings and investments are 180 thousand dollars. We also have a reserve fund of 6000 dollars.

Every summer I earn extra 3,5 thousand dollars on mowing grass - I send this money to my personal retirement account and my spouse's account. The wife also occasionally provides babysitting and tutoring services. This brings another 1,5-2 thousand dollars a year. When the opportunity arises, we sell our stuff on eBay, we earn on this 500-2000 dollars a year. But this item of income will gradually decrease, as children grow up and there are less and less unnecessary things.

My wife and I have been around 50 for years, so we are trying to save all free money for retirement. I want to postpone to old age more, but it rarely turns out. With the growth of children, I hope the amount of retirement savings will grow even faster.

Photo madfientist.com

Household

We bought our house in the spring of 2000 for a little money - 150 thousand dollars (we had 50 thousand thousand of our own dollars and 100 thousand of dollars we borrowed from the bank). We repair it and constantly finish something. The house has 8 bedrooms and 3 bathrooms. Mortgage extinguished back in 2012 year. We hate debts! Now the cost of our house has increased in price to 375-400 thousand dollars. In the future we will be able to count on this capital.

Immediately after the repayment of the housing loan, we used free money for savings, which dramatically increased their size. It was a very important moment in our life. Since then we made a fundamental decision: to save every saved cent. We were not going to spend this money on new cars, trendy clothes, designer food or on expensive trips. Thus, about 1600 dollars per month we began to send to personal retirement and medical bills.

Food

Most of the money a month we spend on food. Children want to eat at least three times a day. To feed everyone, it takes 1300 dollars a month. This amount includes one snack per month away from home. Everyone in our family loves to eat.

We buy simple food: chicken, minced meat, pork, rice, potatoes, vegetables and fruits. We do not adhere to diets.

We never throw food away! If something remains, then we make another dish the next day. Our breakfast consists of bread, bagels, pancakes, eggs, oatmeal and other products. We do not buy expensive cuts of meat, organic food or ready meals. Yes, we would like to, but then we would not have enough money for daily feeding of all mouths. All our children are healthy, in normal weight and in good shape. Children drink a lot of milk (I regret that we do not have three cows), and we drink a lot of water (from the tap, and not from bottles).

Photo madfientist.com

Waste of money

All my children start to work and save at an early age. In 12 years, they already become nannies, mowing grass, cleaning snow with shovels and helping friends and neighbors in small things. They are good support. They pay for their own players, phones, cars, fuel, insurance and college tuition.

Yes, children buy cars themselves and pay for their maintenance. We try to purchase such cars from older people who don’t need them anymore. Cars in good condition and with low mileage. All five older children have their cars. Plus, three cars with my wife. I am sure the neighbors love us.

Education

Children graduate from high school in 16-17 years. If they are going to go to college, they must pay for it themselves. Higher education receive four of our children. My wife and I urge them to go to college for at least two years, and then decide whether they want to continue their studies. While in our family, no one refused higher education. As a rule, there is no need to pay for the first two years, and for the remaining two years the fee is 8-10 thousand dollars per year.

Some of my children were able to get a scholarship of 5 thousand dollars a year, which allows them to cover a significant part of their education expenses. Nobody took out educational loans and did not go into debt.

My eldest child was able to get a master's degree without credits. The daughter got a job in the social sphere, and the state agreed to pay for her education on the condition that she would work for two years. In any case, she wanted to stay, and so received a great advantage from this deal.

Photo madfientist.com

Difficulties and joys

I would like to warn. Everything that is written above is by no means easy. There were sleepless nights with sick children, sudden expenses, endless expenses for diapers and never-ending laundry (for example, now there are weekly 30-35 washes).

I confess that when half a dozen children had an upset stomach at the same time, it seemed that we were drowning in vomiting - I wonder why I did not become a monk and did not run away into the Gobi Desert. Despite this hard work, my wife and I do not regret anything.

I would like to add that all our life we live in the same city. We have great neighbors and great friends. We all help each other.

Despite the simple life, we live with pleasure. We have a nice home and hobbies that we enjoy. My wife spends an hour every morning in the gym, and I run every day. All children go to many activities. Every summer we go for a week sunbathing on the beach. Recently, they allowed themselves to leave home for five days to celebrate their 25 wedding anniversary.

Translate Sravni.ru

Read also on ForumDaily:

Rules Amazon: Secrets of success from the richest man in the world

Top 11 states with the most expensive child care

Where to buy affordable drugs in the US

States where luxury living is cheap

Subscribe to ForumDaily on Google NewsDo you want more important and interesting news about life in the USA and immigration to America? — support us donate! Also subscribe to our page Facebook. Select the “Priority in display” option and read us first. Also, don't forget to subscribe to our РєР ° РЅР ° Р »РІ Telegram and Instagram- there is a lot of interesting things there. And join thousands of readers ForumDaily New York — there you will find a lot of interesting and positive information about life in the metropolis.